The 1600 number series was introduced to improve investor protection and reduce financial fraud. As part of this effort, SEBI has asked all its regulated and registered entities to comply with the latest TRAI 1600 series regulations.

Under these rules, regulated entities must use a 1600 phone number only for service and transactional voice calls made to their existing customers. Regular 10-digit mobile numbers should not be used for such calls.

The purpose of the 1600 number series guidelines is to help investors easily identify genuine service and transactional calls from SEBI-regulated entities. When customers see a call from the 1600 series, they can be more confident that it is legitimate. This reduces confusion, builds trust, and lowers the risk of fraud by unauthorised callers using legitimate mobile numbers.

TRAI 1600 Number Series Guidelines Explained

After the 1600 number series was assigned and numbering resources were allocated to Telecom Service Providers, TRAI began working closely with TSPs and regulators in the BFSI sector. The goal was to ensure smooth adoption of the 1600 phone number series by regulated entities.

As a result of these efforts, around 485 entities have already moved to the 1600 number series, using more than 2,800 numbers. Based on continued discussions with stakeholders, TRAI decided that a time-bound rollout was necessary. This step ensures that entities still using regular 10-digit numbers for service and transactional calls move to the 1600 number series. The shift helps reduce the risk of fraudulent or misleading calls that pretend to come from trusted financial institutions.

TRAI finalised the timelines after consulting the BFSI sector regulators during meetings of the Joint Committee of Regulators. A phase-wise implementation schedule has now been issued under the TRAI 1600 series regulation .

Key Provisions of the Direction

SEBI-Regulated Entities

- Mutual Funds and Asset Management Companies must adopt the 1600 number series by 15 February 2026.

- Qualified Stockbrokers must complete adoption by 15 March 2026.

- Other SEBI-registered intermediaries may shift to the 1600 phone number series on a voluntary basis after verification.

RBI-Regulated Entities

- Commercial banks, including public, private, and foreign banks, must onboard by 1 January 2026.

- Large NBFCs with asset size above ₹5,000 crore, Payments Banks, and Small Finance Banks must onboard by 1 February 2026.

- Remaining NBFCs, Co-operative Banks, Regional Rural Banks, and smaller entities must complete onboarding by 1 March 2026.

PFRDA-Regulated Entities

- Central Recordkeeping Agencies and Pension Fund Managers must adopt the 1600 number series by 15 February 2026.

The timeline for insurance sector entities is still under discussion with IRDAI and will be announced later.

These 1600 number series guidelines focus on structured and phased adoption. The aim is to improve consumer safety and reduce impersonation-based financial fraud via voice calls.

Why Did TRAI Introduce the 1600 Number Series?

The Telecom Regulatory Authority of India (TRAI) introduced the 1600 number series to improve consumer trust and reduce fraud linked to voice calls. The move focuses on making service and transactional calls easy for customers to identify.

In a Direction issued on 16 December 2025, TRAI mandated that entities regulated by the Insurance Regulatory and Development Authority of India must adopt the 1600 phone number series. These entities are required to complete this transition by 15 February 2026. The decision was taken in consultation with IRDAI and follows similar directions earlier issued for entities regulated by RBI, SEBI, and PFRDA.

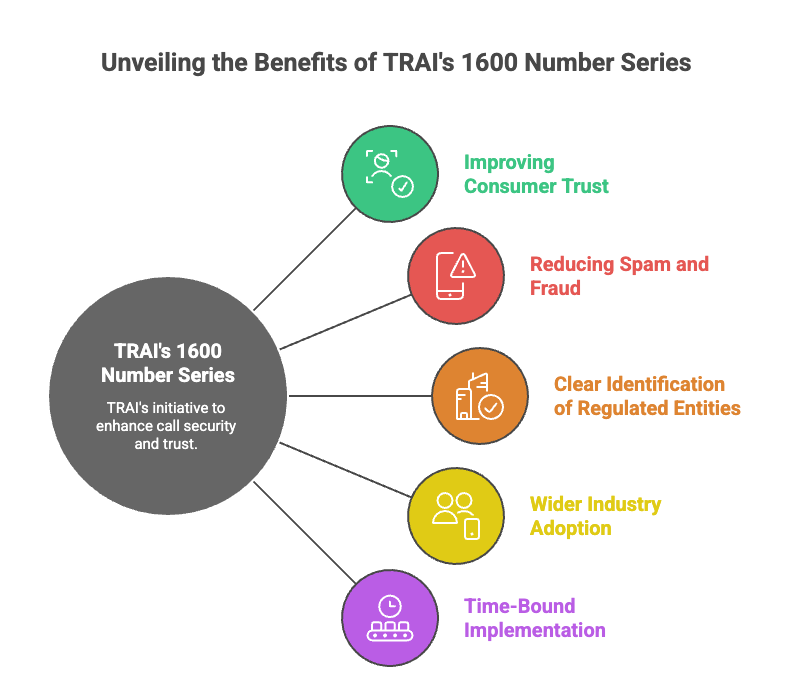

The key reasons behind the TRAI 1600 series regulation include:

- Improving consumer trust: The 1600 number series helps customers quickly recognise genuine service and transactional calls from regulated entities.

- Reducing spam and fraud: Many fraudulent calls misuse regular 10-digit numbers. The 1600 number series guidelines aim to stop this practice.

- Clear identification of regulated entities: The Department of Telecommunications has assigned the 1600 number series to BFSI sector entities and government organisations. This helps separate legitimate calls from other commercial communications.

- Wider industry adoption: TRAI has worked closely with telecom service providers and financial regulators to encourage adoption. Around 570 entities have already adopted the 1600 phone number series, using more than 3,000 numbers.

- Time-bound implementation: TRAI observed that many entities were still using standard mobile numbers. A fixed timeline was introduced to ensure all regulated entities move to the 1600 number series and reduce the risk of impersonation.

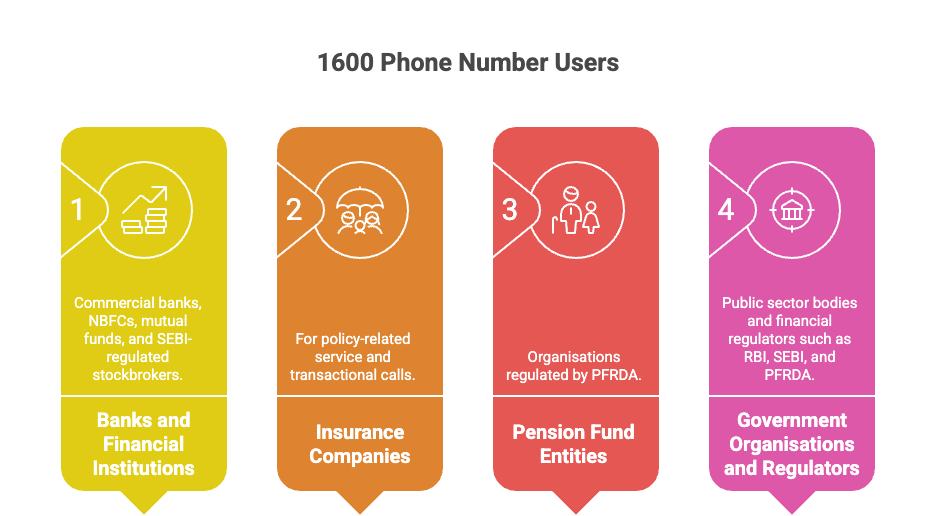

Who Should Use a 1600 Phone Number?

The 1600 number series should be used by the following:

- Banks and financial institutions: This includes commercial banks, NBFCs, mutual funds, and SEBI-regulated stockbrokers.

- Insurance companies: For policy-related service and transactional calls.

- Pension fund entities: Including organisations regulated by PFRDA.

- Government organisations and regulators: Public sector bodies and financial regulators such as RBI, SEBI, and PFRDA.

Why These Entities Use a 1600 Phone Number

- Fraud prevention: The 1600 number series helps customers identify genuine calls and avoid scams made using regular mobile numbers.

- Customer trust and security: Seeing a 1600 phone number makes it easier for customers to trust the call and respond to important alerts.

- Service and transactional calls only: The series is strictly for non-promotional calls such as OTP alerts, payment reminders, policy updates, and account-related information.

What Is the 140 Number Series and Why Does It Exist

The 140 number series is a special 10-digit phone number range in India. It is defined by the Telecom Regulatory Authority of India for telemarketing and promotional calls.

If a call comes from a number starting with 140, it means the caller is a registered telemarketer. These calls are usually made to promote products, services, or offers.

The main purpose of the 140 number series is to control spam calls and make promotional calls easy to identify.

Why the 140 Number Series Exists

- Clear identification of promotional calls: The 140 series helps people instantly know that a call is a sales or marketing call, not a personal or service call.

- Better regulation and monitoring: Only registered telemarketers may use 140 numbers. This allows regulators and telecom operators to track and control telemarketing activity.

- DND compliance: The 140 series works with the Do Not Disturb registry. If a user has opted out of promotional calls, 140 numbers are blocked automatically.

- Spam and fraud control: Using a fixed series makes it easier to detect and block misuse. It also reduces instances of fraudsters impersonating banks or service providers.

Caller Identification Rules: Why 1600 Cannot Be Used for Spam but 140 Can

Different Purpose by Design

The 1600 number series is reserved for service and transactional calls, such as OTPs and payment alerts. The 140 number series is meant for marketing and promotional calls.

Strict Eligibility for 1600 Numbers

Only verified and regulated entities such as banks, insurance companies, and government bodies can use the 1600 phone number.

High Verification Standards

Telecom providers carry out strict checks before assigning a 1600 number series to any entity.

No Promotional Usage Allowed

Spam, sales, or marketing calls are strictly prohibited on the 1600 number series. Violations can lead to penalties or suspension.

Customer Safety and Trust

Calls from the 1600 number series are meant to be trusted. This helps customers clearly identify genuine and critical calls.

140 Series is Built for Promotions

The 140 number series is allocated to registered telemarketers for sales, surveys, and promotional offers.

Regulated but Promotional

140 numbers must follow DND rules, but promotional calling is allowed under defined regulations.

Expected Spam Channel

Since 140 is known for telemarketing, customers expect promotional calls from it. This makes it suitable for spam, unlike the 1600 number series.

Difference Between 1600 Number Series and Other Business Numbers

| Basis of Comparison | 1600 Number Series | Other Business Numbers |

| Purpose | Used only for official service and transactional calls such as OTPs, bank alerts, and policy updates | Used for promotional, sales, marketing, and general business calls |

| Caller Identification | Clearly identifies genuine calls from registered and regulated entities | Can be easily impersonated, making it hard to tell real calls from spam |

| Mandate and Regulation | Mandatory for BFSI and government entities under the 1600 number series guidelines | Not mandatory. Subject to general DND and telemarketing rules |

| Allowed Call Type | Strictly non-promotional service and transactional calls | Promotional and non-promotional calls, depending onthe number type |

| Fraud Prevention | Designed to reduce fraud and impersonation | Frequently misused for spam and scam calls |

| Customer Trust | High trust due to clear identification as a regulated caller | Low trust, as customers often ignore unknown numbers |

How Businesses Can Get a 1600 Number

Step 1: Check Eligibility

The 1600 number series is limited to specific entities. Confirm that your organisation falls under one of these categories:

- Banking institutions such as commercial banks, Payments Banks, and Small Finance Banks

- Financial services firms, including NBFCs, Asset Management Companies, and Mutual Funds

- Insurance companies regulated by IRDAI

- Pension Fund Managers regulated by PFRDA

- Government organisations

Step 2: Contact a TRAI-Approved Service Provider

You must apply for a 1600 phone number through a licensed Telecom Service Provider or Virtual Network Operator.

- Reach out to the provider’s business or enterprise sales team

- Initiate the request for allocation under the TRAI 1600 series regulation

Step 3: Complete DLT Registration

Before activation, registration on a Distributed Ledger Technology platform is mandatory.

- Register your organisation as a Principal Entity

- Map all service and transactional templates, such as OTPs, alerts, and payment updates, to the 1600 number series

Step 4: Submit Documentation and KYC

Provide the required documents to your service provider for verification:

- Company registration certificate

- Business PAN card

- GSTIN

- KYC details of the authorised signatory

- Regulatory approvals from RBI, SEBI, IRDAI, or PFRDA

Step 5: Technical Integration

Once the 1600 phone number is allocated, integrate it into your systems.

- Configure the number in your EPABX or cloud telephony setup

- Update CRM and calling tools to use the 1600 number series for service and transactional calls

Step 6: Follow the Adoption Timelines

TRAI has defined strict deadlines for different entities:

- 1 January 2026 for commercial banks

- 1 February 2026 for large NBFCs, Payments Banks, and Small Finance Banks

- 15 February 2026 for insurance companies, Mutual Funds, AMCs, and Pension Fund Managers

- 1 March 2026 for remaining NBFCs, Cooperative Banks, and Regional Rural Banks

- 15 March 2026 for Qualified Stockbrokers

Eligibility and Availability Limitations of the 1600 Number Series

The 1600 number series is tightly controlled. This is done to protect trust and reduce fraud. It is not open to general businesses or telemarketers.

Eligibility Criteria

Only specific entities can use a 1600 phone number.

- Regulated entities: Access is limited to organisations regulated by RBI, SEBI, IRDAI, and PFRDA.

- Government bodies: Central and state government entities can use the 1600XXXXXX number range.

- Financial institutions: Banks, insurance companies, and stockbroking firms are typically assigned the 1601XXXXXX range under the 1600 number series.

- Mandatory DLT registration: Eligible entities must register on the DLT platform. This ensures every call is verified and traceable.

- Purpose restriction: The 1600 number series can be used only for service and transactional calls. This includes OTPs, transaction alerts, policy renewals, and urgent updates. Promotional or marketing calls are not allowed.

Availability and Limitations

While trusted, the 1600 number series has clear operational limits.

- Outbound calls only: 1600 numbers are for outgoing calls only. Customers cannot call back on these numbers.

- Limited number availability: Each telecom operator gets a limited set of numbers per telecom circle. This can be a challenge for large institutions with high call volumes.

- Circle-based allocation: Numbers are issued state or circle-wise. Pan-India entities may need multiple 1600 numbers across regions.

- System readiness required: Banks and telecom providers often need upgrades to their backend systems to support the 1600 number series.

- Strict migration timelines: Adoption is mandatory. Sector-wise deadlines range from 1 January 2026 to 15 March 2026.

How Businesses Can Procure 1600 Numbers Through Runo

Runo enables businesses to use the 1600 number series as part of their cloud telephony offerings.

When a company is assigned a 1600 series number, often mandated for NBFCs and other regulated industries, Runo integrates it into its cloud calling system. Through Runo’s platform, businesses can easily click-to-dial and place calls online, ensuring customers see the official 1600 number.

This process works like any other cloud telephony service, but with the added benefit of compliance for regulated sectors. In short, Runo simplifies call management and ensures that businesses use their 1600 numbers effectively and compliantly.

FAQs

What is the 1600 number series?

The 1600 number series is a dedicated numbering format for service and transactional calls made by regulated entities.

Who regulates the 1600 phone number in India?

The Telecom Regulatory Authority of India regulates the 1600 phone number under specific compliance guidelines.

Can promotional calls be made using the 1600 number series?

No. The 1600 number series guidelines allow only service and transactional calls.

Is DLT registration mandatory for getting a 1600 number?

Yes. DLT registration is required before a 1600 phone number can be activated.